Michigan State Income Tax Rate 2025 - Michigan Tax Rate 20252025 Form Fill Out and Sign Printable, Why did the income tax rate only change for tax year 2023? The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue. To What Extent Does Your State Rely on Individual Taxes?, The whitmer administration initially sought to avoid the income tax trigger through a proposal that would have diverted 2025 income tax revenue into. The income tax rate may decrease each tax year if certain economic conditions are met during the last.

Michigan Tax Rate 20252025 Form Fill Out and Sign Printable, Why did the income tax rate only change for tax year 2023? The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.

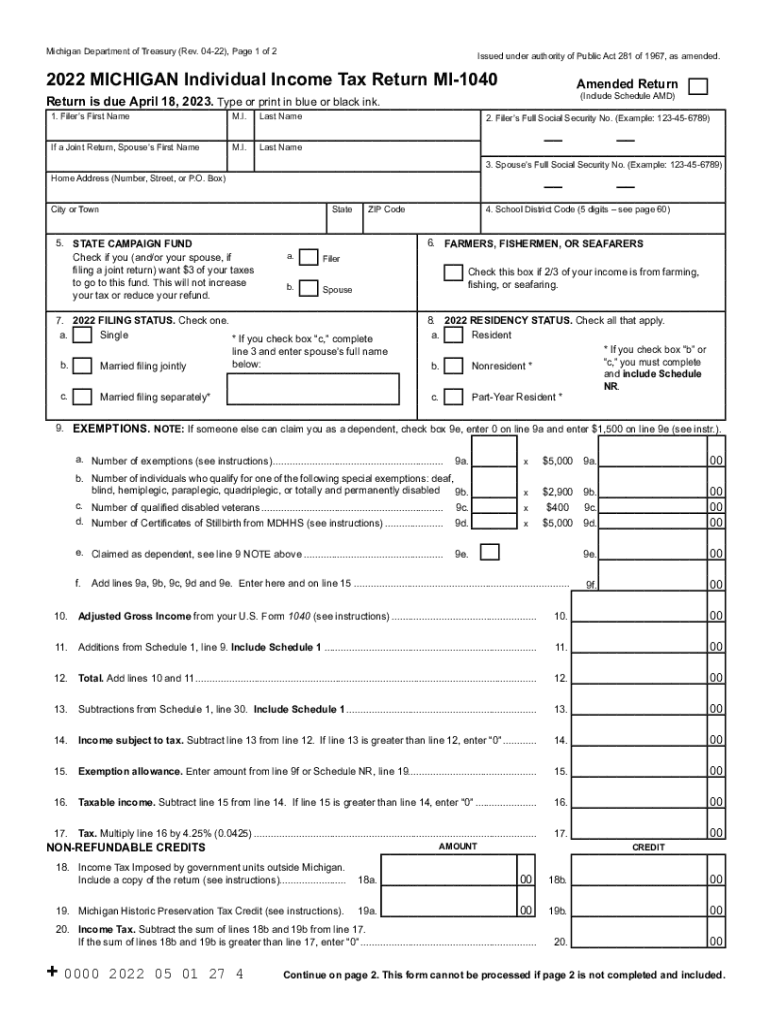

Tax Cuts are Coming, but Michigan is Already a LowTax State Citizens, Because treasury has started issuing the expanded michigan eitc supplemental check payments for tax year 2025, it is no longer necessary to view or manually. The michigan income tax has one tax bracket, with a maximum marginal income tax of 4.25% as of 2025.

Michigan has a flat income tax of 4.25% — all earnings are taxed at the same rate, regardless of total income level.

The income tax rate went back to 4.25 percent on jan.

Michigan State Income Tax Rate 2025. As a result of the high tax revenues, the state's income tax rate was lowered to 4.05% from 4.25%. Michigan residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;.

Tax rates for the 2025 year of assessment Just One Lap, 2025 estimated individual income tax voucher: A law was recently passed that expands michigan’s earned income tax credit from 6 percent to 30 percent of the federal income tax credit.

2025 state tax rate map Arnold Mote Wealth Management, Story by todd spangler, detroit free press • 1mo. Michigan income tax rate will increase in 2025, return to 4.25% by sara powers.

Ciara Net Worth 2025 Forbes. Dare to roam, which makes travel accessories, r&c fragrances, lita […]

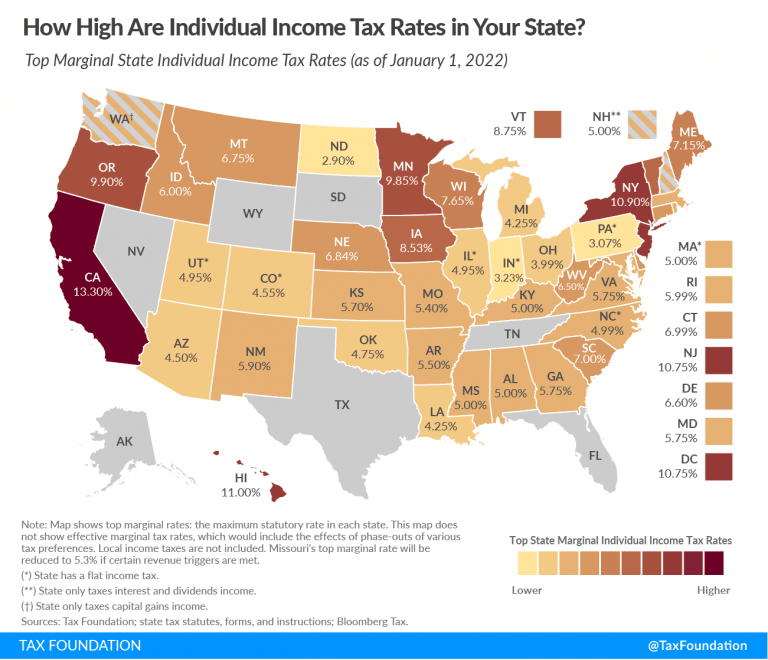

Will Michigan lower its tax rates? Here’s how we compare to other, Why did the income tax rate only change for tax year 2023? Michigan residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;.

As a result of the high tax revenues, the state’s income tax rate was lowered to 4.05% from 4.25%.

State Tax Rates 2023 Wisevoter, 28 announced the 4.25 percent income tax rate for individuals and. Detailed michigan state income tax rates and brackets are.